We aim to influence investment decisions of $3.6T/year to deliver net-zero by 2030. By unlocking the data infrastructure needed to share environmental & financial data we convene organisations to understand how best to use data as a continuous flow of evidence that informs action.

We help instrument and operationalise net-zero by connecting policy, strategy, risk management and investment to real-world data to:

- Enable climate-ready financial instruments

- Enable climate-aware risk management

- Enable climate-credible deployment of robust, long-term solutions

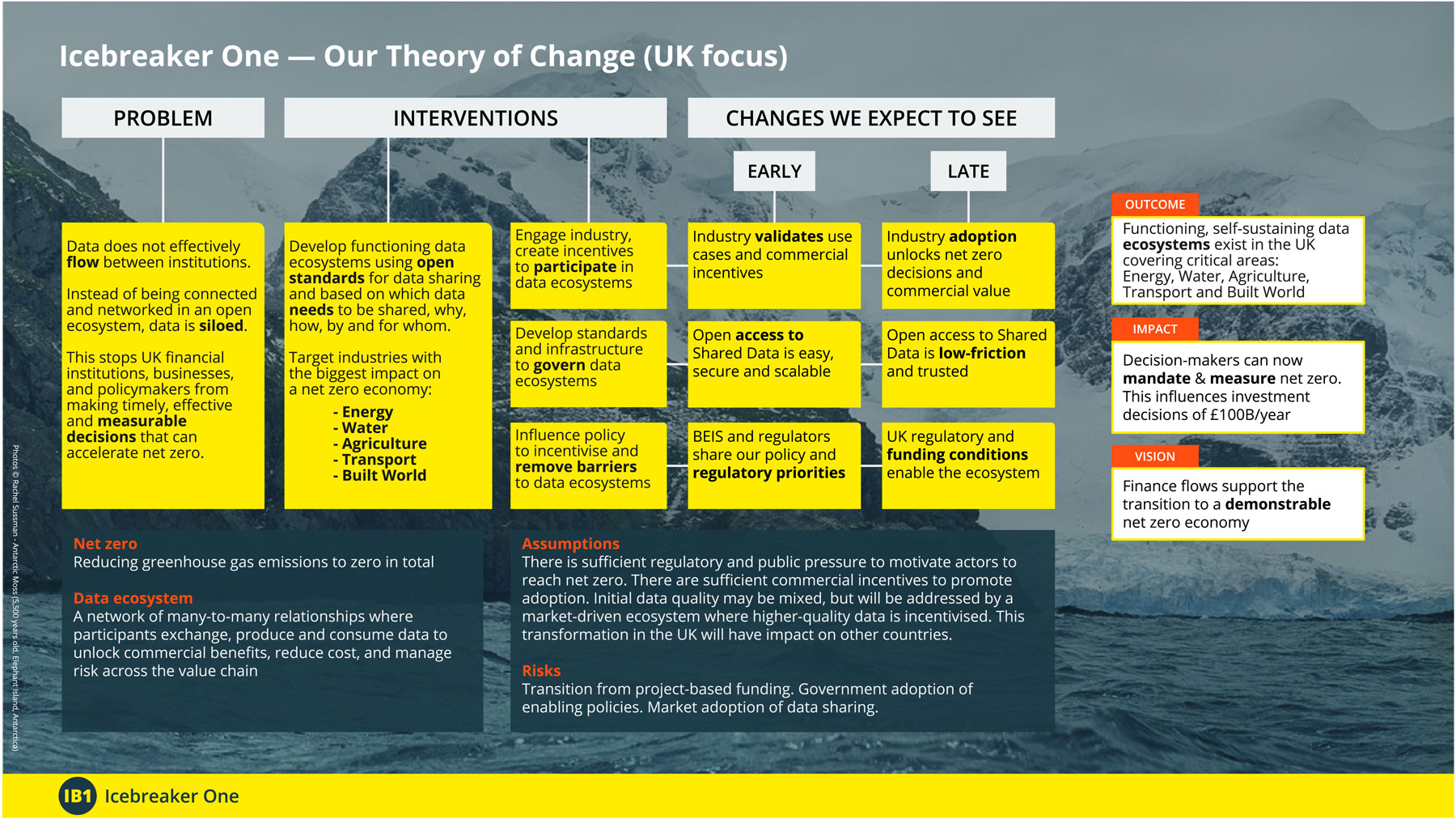

Our Theory of Change

We have developed a Theory of Change (UK-focus in the image above) to illustrate how we are developing our work.

Our central hypotheses include:

- Improving access to data helps businesses and the public sector innovate.

- Working with industry and government to develop Open Standards will unlock open access to shared data.

- Improved access to data is essential to country-level transitions and to deliver a green industrial revolution.

- This is a proven blueprint: with Treasury backing, Open Banking opened up secure access to shared financial data. It has since transformed the fintech sector, creating tens of billions of pounds in value.

- The public sector and regulators can work together with industry to deliver the funding, regulatory change, and convening needed to improve access to data.

Flagship projects — starting with user needs

Icebreaker One is a net-zero market catalyst — exploring how to rapidly evolve our financial and energy systems to embed net-zero into investments and financial decisions in a manner that is demonstrable, provable and uses data to hold market actors to account.

Project Cygnus is exploring how COVID economic recovery can be directed to drive net-zero behaviours at city and regional-levels across Europe. Open Energy is a public-private initiative modernising data sharing across the entire energy grid to deliver a net-zero, decentralised energy future. SERI is helping the insurance sector be a lever of change by developing Climate-Ready products: ensuring that net-zero solutions are protected and incentivised (e.g. some insurers won’t insure EV) as well as driving change so net-destructive industries are no longer financially viable.

- SERI — Standard for Environmental Risk and Insurance

- Open Energy — building the web of energy data

- Cygnus — determining how to finance net-zero COVID-19 economic recovery

Benefits & outcomes

- Address the business models, legal and policy (e.g. rights, licensing, security, liability, regulation) of data sharing

- Develop & share the required expertise and change in knowledge, practice and culture

- Improve the provision, reliability and trust of data publishing

- Develop policy frameworks that address climate-specific interventions across the financial ecosystem

- Unlock the data ecosystem across global sensors, satellites, internet of things (IoT), geospatial, asset registries, risk reporting, trading schemes and financial instruments

- Enable data discovery (e.g. data search) at web-scale: lay the foundations for the web of environmental data

Outputs & activities — instrumenting net-zero

We convene multi-disciplinary experts, teams and organisations across the public, private and scientific communities to develop:

- Open standards

Frameworks for robust and secure data sharing across environmental & financial data: principles and practice, Code(s) of Practice, voluntary standards, regulated Standards. - Impact accelerator

Increased speed-to-market of financial and technical products and services that enables investment flow to net-zero solutions through partnerships with existing innovation vehicles - Accreditation & certification services

Products and services that ensure the development of a robust data marketplace - Research and evidence

Use-cases, reports, business models, economic modelling, policies and guidance. - Communication

Reporting on the evidence of innovation and the impact of activities. In public, trade and expert forums. - Training

Bridge the gaps between theory and practice - Events

Connecting expertise across siloes - Collaborative practices

Working groups (large and small; in-person and online)

Context

Build on the principles of Open Finance & Open Banking and bring together multidisciplinary teams across the public and private sectors.

Next steps

- Sign-up to our mailing list for invitations and research, or join as a member —https://icebreakerone.org/join

- Read our long-form narrative below